If you’re looking for a mortgage professional who can not only crunch numbers but also communicate clearly, guide you through complex lending scenarios, and genuinely cares about your success, meet Andrew Semple and his top-tier team at PrimeLending in Springfield, MO. With hundreds of 5-star reviews across Zillow, Google, Facebook, and more, Andrew’s clients consistently …

Down Payment & Assistance Programs: Top 10 Questions Answered for First-Time Homebuyers in Springfield, MO

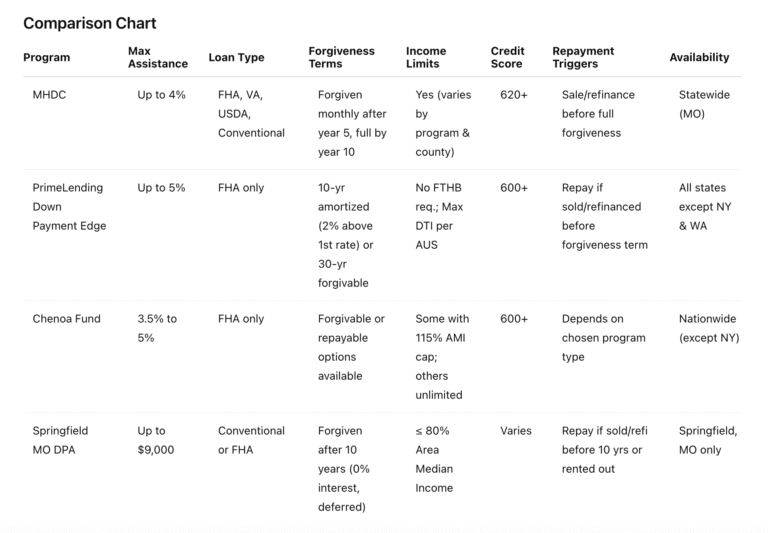

Picking up where we left off yesterday, we’re diving into the second core section of questions first-time homebuyers are asking in 2025: Down Payment & Assistance Programs. If you’re house-hunting in Springfield, Missouri or anywhere in the state, programs like MHDC, PrimeLending Down Payment Edge, Chenoa Fund, and Restore Springfield can help you bridge the …

Tips for Saving Up for a Down Payment

Can you imagine how long it would take to buy a house if you had to pay for it in full? Thankfully we have home loans, but when it comes to buying a home, saving up for a down payment is still usually the biggest hurdle potential homebuyers face. Mortgage payments can be comparable to …

Why and How You Should Avoid Paying PMI

If you’re eager to buy a home but can’t quite afford that 20% down payment, it might be tempting to purchase private mortgage insurance (PMI). PMI is the only option for some homebuyers, but for others, it is a choice. Today we’re going to look at why and how you should avoid paying PMI. What …

Do I Have to Put 20 Percent Down When Buying a House?

Oh, the dreaded down payment. When looking into buying a house, many people are comfortable with the idea of mortgage payments—sometimes they’re even lower than what the homebuyer was paying in rent! Down payments, on the other hand, are sometimes feared. Saving money takes time and discipline and depending on the price of your prospective …