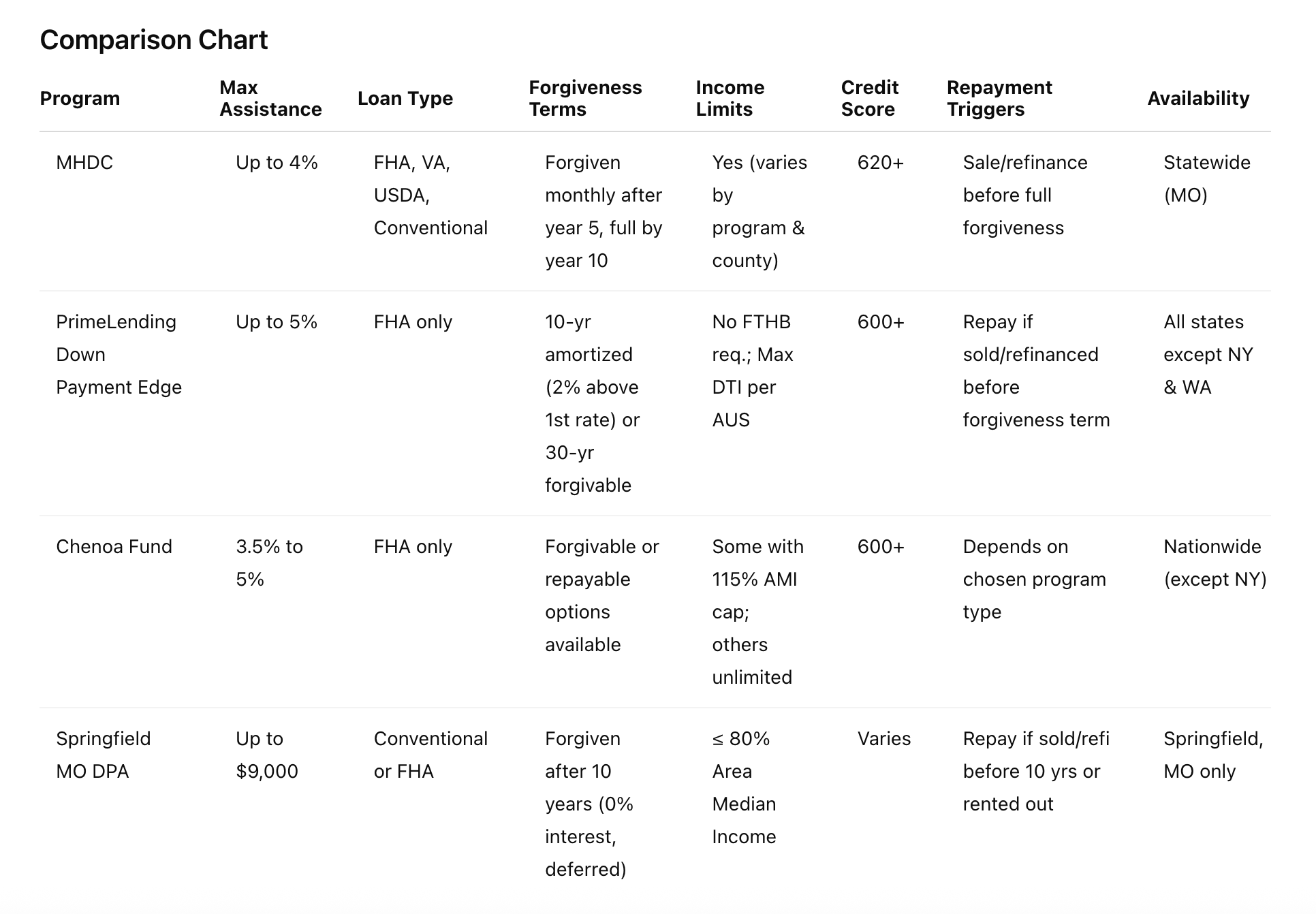

Picking up where we left off yesterday, we’re diving into the second core section of questions first-time homebuyers are asking in 2025: Down Payment & Assistance Programs. If you’re house-hunting in Springfield, Missouri or anywhere in the state, programs like MHDC, PrimeLending Down Payment Edge, Chenoa Fund, and Restore Springfield can help you bridge the affordability gap. Here are the top 10 questions and what you need to know:

1. How much do I need for a down payment?

- MHDC: Offers a forgivable second mortgage up to 4% of the home’s purchase price.

- PrimeLending Down Payment Edge: Offers up to 5% assistance via an amortized or forgivable second mortgage.

- Chenoa Fund: Offers 3.5% to 5% assistance on FHA loans with both forgivable and repayable options.

- Springfield MO DPA: Offers up to $9,000 as a zero-interest deferred loan, forgiven after 10 years if conditions are met.

2. Can I use gifted funds from family?

Yes! All of these programs allow you to combine gifted funds with their assistance options. You’ll just need to document the gift with a letter and evidence of transfer.

3. What grants or first-time buyer programs exist?

- MHDC: First Place, Next Step, and Mortgage Credit Certificates (MCC).

- PrimeLending Down Payment Edge: No first-time homebuyer requirement. Available in all states except NY and WA.

- Chenoa Fund: Nationwide coverage (except NY), no first-time buyer requirement.

- Springfield MO DPA: Designed specifically for first-time buyers purchasing within city limits.

4. How do USDA, FHA, VA loans differ with these programs?

- MHDC: Compatible with FHA, VA, USDA, and Conventional.

- PrimeLending Down Payment Edge: FHA loans only.

- Chenoa Fund: FHA loans only.

- Springfield MO DPA: Can be paired with FHA or conventional loans from approved lenders.

5. What are income or price caps on assistance?

- MHDC: Yes, varies by county and program, contact Andrew Semple with PrimeLending for more details.

- PrimeLending Down Payment Edge: No first-time homebuyer requirement; max DTI upto 45%.

- Chenoa Fund: Some programs cap at 115% of Area Median Income (AMI); others have no cap.

- Springfield MO DPA: Borrower income must be ≤ 80% of Average Median Income (AMI) for the area; purchase price typically capped at $150K–$175K.

6. Are there regional/state down payment grants nearby?

Yes! In addition to MHDC’s statewide options and the Springfield MO DPA, PrimeLending and Chenoa Fund offer broad multi-state support. Also look into Restore SGF grants, Springfield Community Land Trust, and other local nonprofits.

7. What’s the tax impact of gifted/down payment help?

- Gifts: Not taxable to the buyer. Donors may need to file a gift tax return if over $18K/year.

- MHDC MCC: Up to $2,000/year federal tax credit.

- Forgivable loans (like from Chenoa, MHDC, PrimeLending Edge and Restore Springfield): Generally not considered taxable income.

8. Is it better to delay and save 20% or buy now with less?

With forgivable assistance programs, many buyers find it better to buy now and start building equity. These programs help reduce the barrier to entry without long-term repayment obligations, as long as you stay in the home for the required time.

9. What types of assistance loan structures exist?

- MHDC: Forgivable second mortgage over 5 to 10 years.

- PrimeLending Down Payment Edge: Choose between a 10-year amortized second (2% above 1st mortgage rate) or a 30-year forgivable second at 0% interest.

- Chenoa Fund: Offers both repayable and forgivable second mortgages.

- Springfield MO DPA: Deferred loan forgiven after 10 years.

10. Can I stack the DPA with my first mortgage approval?

Yes! Each of these programs works in coordination with your first mortgage:

- MHDC: Works with approved lenders like PrimeLending on most loan types

- PrimeLending Down Payment Edge: Integrated with FHA approvals.

- Chenoa Fund: Paired with approved FHA lenders.

- Springfield MO DPA: Must work with a city-approved lender.

If you’re unsure which program fits your needs best, or if you want to start the pre-approval process, contact me today. I specialize in helping first-time homebuyers secure funding through these programs and more.

Andrew Semple

417-616-0872

Sr. Mortgage Lender | Springfield, MO

NMLS #771096 | PrimeLending

Schedule a Call

Calculate Your Payment